Just like in the stock market, an investor can apply numerous strategies. One of these strategies is Dollar Cost Averaging (DCA). This strategy provides structure and stability. In this article, we explain what DCA entails, how it works in the crypto market, the pros and cons of this investment strategy, and offer alternative methods to invest in Bitcoin and other crypto.

What Is Dollar Cost Averaging (DCA) and How Does It Work?

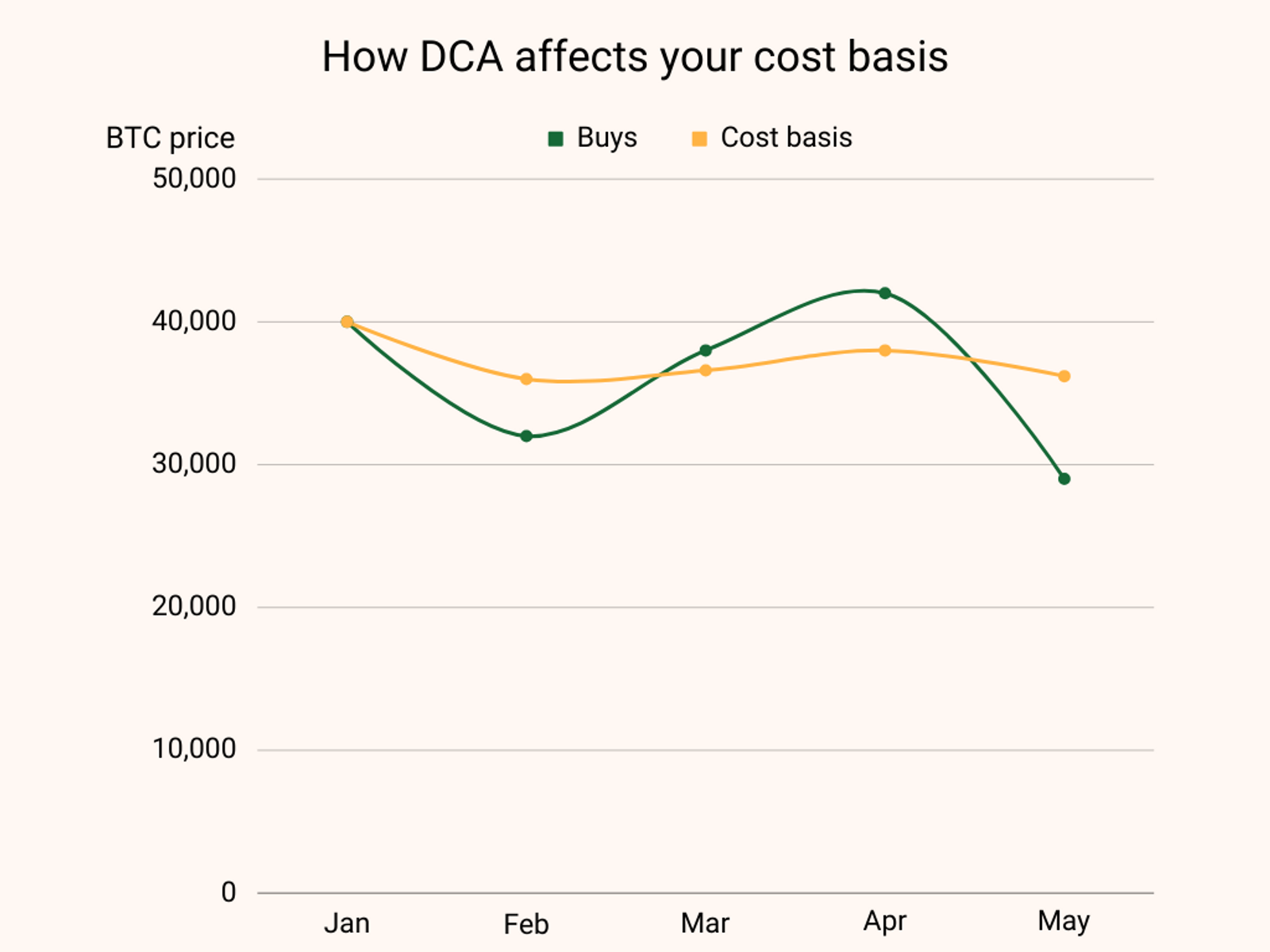

Dollar Cost Averaging is an investment strategy where investors consistently invest a fixed amount at regular intervals. For example, every first day of the month or weekly on Friday morning. Investors do not consider the current price of the cryptocurrency or stock, as this technique is equally applicable to stocks.

The idea behind DCA is simple but powerful: market timing is something almost no one can achieve. Instead, one plans to buy at a fixed moment. This way, the purchase price will experience both peaks and valleys, averaging out over time. This reduces the risk associated with price fluctuations while allowing one to benefit from long-term price increases.

An additional advantage of the DCA method is that an investor has more peace of mind: there is a fixed plan to adhere to, eliminating the need for monthly recalculations and market price assessments.

How Does DCA Work in Crypto Investing?

To start applying the DCA strategy in crypto, it is essential to make some decisions. Determine the interval at which you want to invest, such as once a month. Keep in mind that shorter intervals may incur relatively higher commissions and transaction fees.

Next, decide on the fixed amount you wish to invest periodically. Ideally, this should be a constant amount to avoid giving different weights to various periods due to price fluctuations. Consider the risks and determine what is feasible for you and your financial goals. Make informed choices and regularly reassess whether the strategy still suits you.

The Pros and Cons of the DCA Strategy

Like any strategy, DCA has notable pros and cons. The advantages of DCA include:

- Risk Management: Spreading investment moments reduces the chance of buying only during peak times.

- Peace of Mind: Adhering to a schedule avoids impulsive decisions and eliminates the need for periodic in-depth price analysis.

- Simplicity: DCA is relatively easy to apply, making it suitable for novice investors.

A downside is the potential costs. Regular purchases mean frequent transaction fees. Additionally, sticking to a fixed schedule might miss out on opportunities, such as a rapid price drop in a cryptocurrency.

Alternative Trading Strategies in Crypto

Besides DCA, there are other strategies to consider, ranging from personal choices to widely known methods. Some approaches commonly mentioned among crypto investors include:

- Lump Sum Investing: Investing the entire capital at once. This is advantageous when market prices are very low, and the investor expects them to rise. It can also result in relatively lower transaction costs. However, if the prices drop after investing, the average purchase price cannot be lowered. This method is generally considered riskier than DCA.

- Day Trading: For those with time and interest, day trading involves frequent daily buying and selling to capitalise on price fluctuations. Successful day trading typically requires professional tools and technical knowledge.

- Swing Trading: This involves holding positions for a few days to a few weeks. It is less volatile than day trading. Swing traders often use fundamental analysis to base their decisions.

- Asset Management: With crypto asset management, funds are managed (which can be lump sum, DCA, or whenever convenient), and the asset manager buys and sells crypto on behalf of the investor.

No matter which strategy is chosen, none are completely risk-free. This applies to crypto as well as traditional financial markets. Consider your situation and preferences when choosing a strategy. DCA is a low-threshold method anyone can apply without technical knowledge and is best suited for investors with a long-term horizon.

The information provided in our articles is intended solely for general informational purposes and does not constitute (financial) advice.

Subscribe to our newsletter

Everything you need to know about Bitcoin, straight to your inbox. Subscribe now for the latest from Blockrise.